In an era of global financial volatility and rising uncertainty, Bitcoin (BTC)—once a playground experiment for tech enthusiasts—has entered a period of profound redefinition. It is no longer just a speculative asset for traders or a technological curiosity for developers. Instead, Bitcoin has evolved into a fully recognized asset class now under the scrutiny of global regulators and financial institutions alike.

As Solo Miner observes, Bitcoin’s dual nature—oscillating between a safe-haven and a risk asset—reflects a deeper contest over its long-term identity. Yet, what truly defines the current industry transformation is not merely price volatility. It is the sweeping structural overhaul initiated by governments and regulators worldwide.

For over a decade, the forces that drove Bitcoin and blockchain growth could be divided into three relatively independent ecosystems: the “Coin Circle,” the “Chain Circle,” and the “Mining Circle.”

The Coin Circle focused on asset trading and speculation.

The Chain Circle centered on technical infrastructure and decentralized applications.

The Mining Circle—anchored by physical hardware like the asic miner, lotto miner, and large-scale bitcoin miner farms—provided the computational backbone of the entire ecosystem.

These three domains functioned like parallel rivers: each powerful in its own channel, occasionally intersecting, but rarely cooperating in depth. This “fragmented prosperity” fueled explosive growth in the early years, but it also bred systemic fragility.

Now, under the combined gravitational pull of global regulation—from the U.S. SEC’s shift toward rule-based oversight to the EU’s MiCA framework—these rivers are finally converging.

This article takes readers inside this unprecedented “survival game”:

Why can the old fragmentation no longer sustain itself?

How does regulation reshape the industry’s DNA?

And how can ordinary investors find the right balance between opportunity and safety in this new, compliant crypto economy?

1: The Structural Rift of the Wild Growth Era — The Three-Way Divide Between Coin, Chain, and Mining

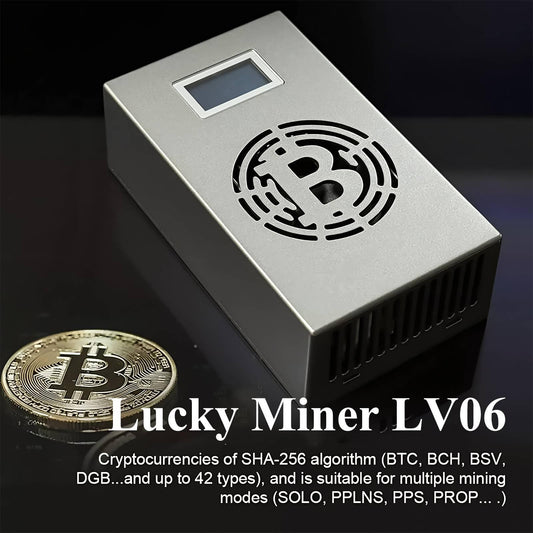

Lucky Miner LV07 1T ASIC Miner – $139.00

Between 2014 and 2021, often called the “golden era” of crypto, the industry expanded at an exponential rate. Yet internally, the Coin Circle, Chain Circle, and Mining Circle remained sharply divided—like rival kingdoms separated by the “Chu–Han boundary” on an ancient Chinese chessboard.

This structural rift initially encouraged specialization in each domain but left deep vulnerabilities beneath the surface.

1.1 How the Divide Formed: Assets, Applications, and Hardware in Isolation

To understand this fragmentation, we must first clarify the unique functions and focus areas of each circle.

The Coin Circle (Crypto Assets & Trading)

Core mission: Financialization and circulation of digital assets.

Focus areas: Price volatility, market sentiment, trading slippage, and wallet security.

Example: During the 2017 ICO boom, countless projects issued tokens on primary markets, which were then rapidly listed on exchanges. Retail investors often cared only whether a token could “10x” overnight—not whether it had genuine technology or whether its network relied on a crypto miner or a btc miner for security.

The Chain Circle (Blockchain Infrastructure & Applications)

Core mission: Building the technical and application layer of blockchain ecosystems.

Focus areas: Public-chain performance, smart contract security, decentralized app (DApp) retention, and tokenomics design.

Example: A GameFi project on Ethereum might attract millions of users with strong gameplay and token incentives. Yet developers rarely concern themselves with the bitcoin miner network or how exchanges handle transaction pressure behind the scenes.

The Mining Circle (Bitcoin Mining & Hardware Infrastructure)

Core mission: Managing physical, capital-intensive infrastructure and producing hash power.

Focus areas: Miner efficiency (TH/J), power costs, data center logistics, and network difficulty.

Example: Mining operators invest heavily in energy sourcing, policy negotiation, and cooling thousands of asic miners. They produce the raw BTC that fuels the market—but play a passive role in speculative trading or blockchain app development.

1.2 The Cost of Fragmentation: Risk Transmission and Erosion of Trust

This siloed structure, operating in a regulatory vacuum, created systemic risks across the entire crypto ecosystem.

-

Capital Misallocation and Speculative Dominance

The Coin Circle’s speculative frenzy diverted capital from genuine innovation. During the 2017–2018 ICO mania, billions of dollars were raised—yet many projects collapsed as “air tokens.” This bubble deprived the Chain Circle of sustained R&D funding, driving away top developers and weakening long-term innovation.

2. The Detachment of Hash Power and Finance

The Mining Circle—the backbone of Bitcoin’s security—operates under long investment cycles and heavy fixed costs. But mining profitability depends entirely on token prices set by speculative markets. When prices crash, miner orders collapse overnight, causing shockwaves upstream.

After China’s 2021 crackdown on Bitcoin mining, global hash power migrated to the U.S., Kazakhstan, and Canada. While this rebalanced geography, it also revealed vulnerabilities in energy policy and financial exposure. According to Cambridge CCAF, this shift introduced new geopolitical and sustainability risks.

In essence, the past decade of “wild growth” saw each circle excel in isolation:

The Coin Circle drove market imagination.

The Chain Circle advanced technical possibility.

The Mining Circle sustained physical execution.

But without a shared compliance framework or trust mechanism, these interactions resembled a short-term game of asymmetric information rather than a coordinated industrial ecosystem.

When the global compliance wave hit, the fragmented crypto world was caught off guard.

In the next chapter, we’ll examine how regulators—from the SEC to the EU—are dismantling these barriers and forcing a historic restructuring across all three circles.

2: From Bitcoin to Lottery Mining — How the New Model Works

When Bitcoin’s creator, Satoshi Nakamoto, first introduced mining in 2009, it was simple: anyone with a CPU could contribute computational power to the network, verify transactions, and potentially find the next block — earning 50 BTC as a reward. But as the network grew, so did competition. GPUs, FPGAs, and ASICs quickly replaced CPUs, pushing mining into an arms race dominated by specialized hardware and industrial-scale farms.

Yet beneath this high-stakes competition lies a fundamental truth: mining has always been probabilistic.

Every miner, regardless of hash rate, participates in a global lottery — repeatedly guessing random numbers (hashes) to find one that meets the Bitcoin network’s difficulty target. The more hashes you compute per second, the more “lottery tickets” you buy. But even a single hash, in theory, could win.

That’s the foundation of Lottery Mining — a return to the purest form of proof-of-work.

1. Mining as a Game of Probability

In traditional Bitcoin mining, profitability depends on your share of the total network hash rate. If your machine represents 1% of the global power, you can expect roughly 1% of the total rewards over time.

But Lottery Miners flip this logic. Instead of pooling hash power or chasing predictable yields, they embrace the randomness. A device running at just 7 TH/s (trillions of hashes per second) might only have a 0.000001% chance of finding a block — but if it does, it wins the full 3.125 BTC block reward (plus fees), worth over $200,000 at 2025 prices.

This lottery-like model turns small, affordable miners into long-term participants in a digital game of luck.

> “You’re not competing with industrial farms — you’re playing the same lottery they are,”

> writes Reddit user cbsolo, who famously solo-mined a full Bitcoin block using a modest home setup in early 2024.

The thrill isn’t in guaranteed returns — it’s in participation and possibility.

2. The Rise of the ‘Lotto Miner’

The term “Lottery Miner” (or “Lotto Miner”) emerged around 2023 in global crypto communities like Reddit and Bitcointalk. Early adopters began experimenting with small, USB-powered mining devices that could connect directly to mining pools supporting solo mining or lottery modes.

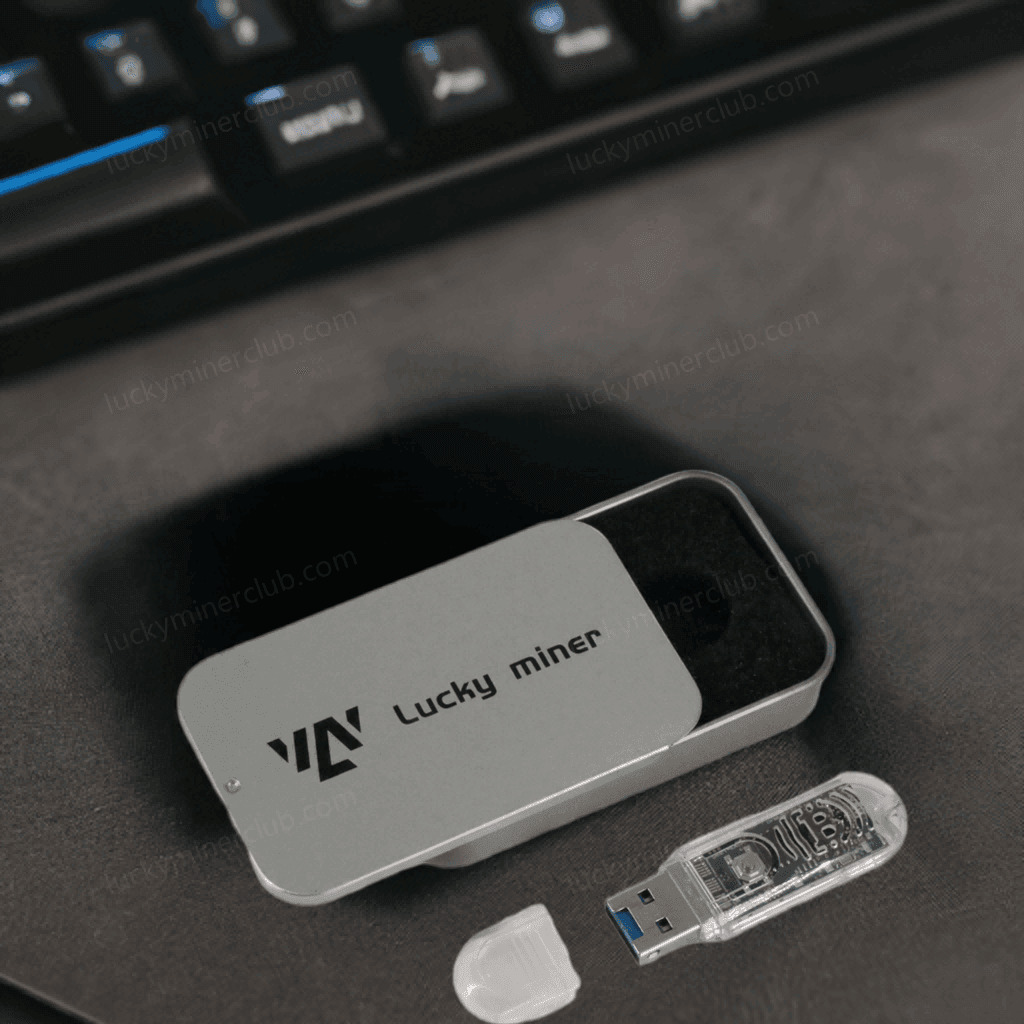

Unlike traditional ASIC rigs that require high-voltage power and cooling systems, these devices are minimalist — often smaller than a smartphone, silent, and consuming as little as 1 to 5 watts.

Manufacturers such as Lucky Miner, Bitaxe, and BG02 pioneered this form factor, focusing on accessibility, affordability, and decentralization. For less than the price of a pair of headphones, users could own a functioning Bitcoin miner that runs 24/7 from a USB port.

The idea caught fire across DIY and open-source circles. Hobbyists began sharing setup guides, firmware tweaks, and even 3D-printable cases. Some users run entire “lottery mining farms” of dozens of USB miners plugged into hubs, each spinning the wheel for a lucky block.

3. The Math Behind the Luck

Let’s put probability into perspective.

As of mid-2025, the Bitcoin network’s total hash rate hovers around 700 EH/s (exahashes per second) — that’s 700 quintillion hashes every second. A 7 TH/s Lotto Miner represents just one hundred trillionth of that power (0.000000001%).

In pure math terms, the expected time to find one block is enormous — possibly decades or even centuries for a single device. But because each hash is independent, it’s statistically possible to win anytime.

Think of it like a digital Powerball ticket that never expires.

And here’s the twist: while large industrial miners chase predictable ROI, Lotto Miners run cheap and constant, turning probability itself into entertainment — and sometimes, into a viral miracle.

In 2024, a solo miner using a modest Antminer S9 (13.5 TH/s) found a full block reward worth over $160,000, defying the odds of 1 in a billion. Such stories fuel the passion of Lotto Miner enthusiasts worldwide.

4. The Technical Infrastructure Behind Lottery Mining

Behind this cultural movement is a quietly evolving technical foundation.

Solo Mining Pools: Platforms like CKPool, SoloPool.org, and ViaBTC’s Solo mode allow small miners to participate individually without relying on shared payouts. They provide real-time stats, hash monitoring, and transparent block discovery records.

Open Firmware: Open-source firmware like Bitaxe Ultra’s ESP32-based controller enables customization and lightweight solo mining. Users can modify clock speeds, power profiles, or pool connections directly through web interfaces.

Smart Integration: Some Lottery Miners now include mobile apps and cloud dashboards for monitoring hash rates, temperatures, and uptime remotely. Others even connect to IoT networks, enabling “smart home mining” setups that combine renewable energy tracking and automated scheduling.

This ecosystem blurs the boundary between crypto mining hardware and consumer electronics — transforming mining into a tech hobby rather than an industrial operation.

5. The Cultural Appeal: Mining Meets Fun

The appeal of Lottery Miners goes beyond profitability. For many, it’s about community, experimentation, and curiosity.

Forums and Discord channels are filled with stories of enthusiasts customizing their miners, sharing screenshots of “lucky shares,” and running small competitions to see whose miner “gets lucky” first.

It’s part nostalgia, part innovation.

Just as early Bitcoiners mined blocks for fun in 2010, today’s Lotto Miners rekindle that same pioneer spirit — blending modern technology with the thrill of the unknown.

For some, the devices double as conversation pieces — small blinking boxes on a desk that symbolize participation in a global decentralized network. For others, it’s a gentle way to learn about blockchain mechanics without heavy investment.

> “It’s not about profit,” says LuckyMinerClub.com community member @SatoshiHobbyist.

> “It’s about being part of something — keeping the network alive and having fun while you’re at it.”

6. Economics of Accessibility

Traditional Bitcoin mining demands high upfront costs and technical expertise. A single ASIC rig can cost over $2,000 and draw 3,000 watts of power — often making home setups impractical.

By contrast, Lottery Miners lower the entry barrier dramatically. With as little as $20 and minimal power use, anyone can join. This cost-efficiency turns mining into a consumer experience, not a corporate monopoly.

Moreover, as Bitcoin matures and halving events continue to reduce rewards, smaller, decentralized participation becomes strategically important for the network’s health. It ensures that block validation remains distributed, protecting Bitcoin from centralization and censorship risks.

In essence, Lotto Miners aren’t just devices — they’re symbols of crypto’s original ethos: freedom, fairness, and decentralization.

3: The Home Mining Revolution — From Heavy Industry to Consumer Electronics

For years, Bitcoin mining has been viewed as an industrial pursuit — loud, hot, and energy-hungry. A far cry from the grassroots spirit of crypto’s early days, it became an arms race fought in warehouses rather than homes. But as the pendulum swings back in 2025, a quiet revolution is underway: the rebirth of home mining.

1. The “Industrial Era” of Bitcoin Mining

From 2016 to 2023, the term “mining farm” symbolized the apex of crypto capitalism. Rows of ASIC machines filled giant metal containers, drawing megawatts of power and generating noise levels over 90 decibels — comparable to a jet engine.

These industrial miners were strategically located near hydroelectric dams in Sichuan, wind farms in Texas, or geothermal plants in Iceland. Mining was optimized for scale, not accessibility.

The economics favored giants. Bulk electricity contracts, specialized cooling systems, and cheap hardware sourcing allowed industrial miners to dominate. Meanwhile, solo miners were priced out — unable to compete in an environment where profit margins depended on economies of scale and access to cheap energy.

Bitcoin mining had evolved from a decentralized experiment into a form of digital heavy industry.

But that dominance came at a cost. Centralization of hash power, environmental criticism, and the exclusion of small participants sparked a backlash — one that would eventually fuel the home mining movement.

2. Enter 2025: The Year of the Home Miner

The year 2025 may well be remembered as the first true year of the home miner — the point where crypto mining transitioned from industrial infrastructure to consumer electronics.

The factors driving this shift are clear:

Energy efficiency breakthroughs: New-generation chips like BM1366 and ESP32-based controllers can achieve meaningful hash rates at ultra-low wattages (1–10W).

Lower hardware costs: USB miners such as Lucky Miner BG02 and Bitaxe Ultra retail between $20 and $80, bringing mining back to a mass-market audience.

User-friendly interfaces: Plug-and-play setups and mobile dashboards have replaced command-line installations, allowing even beginners to start mining within minutes.

Cultural nostalgia: The Bitcoin community has rediscovered its DIY roots — combining curiosity, fun, and the dream of a lucky block discovery.

This combination of factors has turned home mining from a fringe curiosity into a global trend.

On Reddit, Telegram, and Discord, communities dedicated to “lotto mining” and “home hash hubs” have exploded in size. Some members proudly display setups powered by solar panels or recycled PC components — proving that mining can be sustainable, silent, and social.

3. The Fusion of Mining and Consumer Electronics

What makes Lottery Miners revolutionary is not just their affordability — it’s their integration into everyday life.

These devices aren’t just miners; they’re also smart gadgets. Many now include Wi-Fi modules, RGB indicators, and energy-tracking dashboards. Some even double as desk accessories, routers, or IoT nodes.

Take Lucky Miner’s BG02, for example. With 7 TH/s of hash power and less than 5W of energy draw, it connects via USB-C and runs quietly in the background. It’s designed for home environments — operating safely, efficiently, and almost invisibly.

This shift parallels the evolution of consumer tech itself. Just as personal computers replaced mainframes, and smartphones replaced pagers, Lottery Miners are transforming mining from an industrial activity into a consumer experience.

Soon, they might not even look like miners at all — but like everyday appliances that happen to generate digital rewards while you sleep.

4. Economics of Home Mining

At first glance, running a 5W Lotto Miner might seem financially insignificant. After all, with such low hash rates, the probability of hitting a block is minuscule. But this overlooks the psychology and economics of accessibility.

Let’s break it down:

| Metric | Industrial Miner | Home Lottery Miner |

|---|---|---|

| Hardware Cost | $2,000–$5,000 | $20–$80 |

| Power Draw | 2,500–3,000W | 1–5W |

| Noise Level | 80–90 dB | < 20 dB |

| Setup Difficulty | High | Plug-and-play |

| Profit Model | Predictable ROI | Lottery Probability |

For industrial miners, the goal is consistent yield — measured in dollars per day. For home miners, it’s participation and potential — the thrill of possibility combined with long-term engagement.

More importantly, the cost of ownership is so low that the downside risk is negligible. A $40 Lotto Miner running on less than $1/month in power can operate indefinitely. Even if it never wins, it serves as a learning tool, a conversation starter, or a way to support the Bitcoin network’s decentralization.

And when it does win — it’s life-changing.

5. Community: The Social Fabric of Home Mining

Home mining has always carried an emotional dimension — the sense of being part of something bigger. The new wave of Lottery Miners has reignited that spirit, blending hobbyist enthusiasm with a decentralized purpose.

Online communities are filled with photos of desk setups, 3D-printed miner cases, and “hash rate walls.” Some users compete in “mining marathons,” keeping their devices running continuously to test endurance. Others use their miners to teach kids about Bitcoin and blockchain.

It’s not just about computation — it’s about connection.

Platforms like LuckyMinerClub.com have become community hubs where enthusiasts share success stories, firmware upgrades, and pool strategies. The tone is casual yet passionate — proof that mining has re-entered the mainstream conversation, not as a corporate endeavor but as a social and creative pursuit.

6. Beyond Bitcoin: Expanding the Home Mining Ecosystem

While Bitcoin remains the primary focus, the concept of lottery-style, low-power mining is expanding across other ecosystems.

Projects exploring similar ideas include:

Kaspa & Nexa: Lightweight proof-of-work blockchains optimized for CPU and small ASIC devices.

Namecoin & Handshake: Decentralized domain and identity networks where home mining contributes to infrastructure stability.

Dogecoin (merged mining): USB miners can indirectly support Dogecoin through merged-mining pools.

This diversification hints at a broader trend: the mainstreaming of micro-mining, where energy-efficient devices become nodes in Web3 infrastructure — a future where owning a miner might be as common as owning a Wi-Fi router.

7. Why 2025 Matters

Every technological movement has its inflection point. For Bitcoin mining, 2025 could mark that moment — the transition from industrial exclusivity to consumer inclusivity.

Lottery Miners are at the heart of this change. They aren’t just gadgets; they’re symbols of decentralized empowerment. They remind us that the future of blockchain doesn’t belong solely to data centers, but to millions of individuals who choose to participate, however small their contribution may be.

Mining is coming home — literally.

4: The Future of Lottery Mining — From Power Plugs to Web3 Homes

The story of Bitcoin mining is, at its core, a story of decentralization. From its origins in dorm rooms and laptops to its evolution into billion-dollar data centers, mining has mirrored the larger tension within crypto: the struggle between scale and accessibility.

Now, as technology circles back to its roots, a new frontier emerges — one where mining becomes part of everyday life, embedded seamlessly into homes, appliances, and smart devices. This is the vision behind the Web3 household — a future where every home contributes to the blockchain network, consciously or passively, through connected devices like Lottery Miners.

1. The Web3 Household: Decentralization at Home

The Web3 household is more than a buzzword — it’s a technological paradigm shift.

In this model, homes are not just consumers of digital services but active participants in decentralized networks. Your router might secure transactions. Your refrigerator might run a lightweight node. Your USB Lotto Miner could validate blocks while you sleep.

This represents the convergence of three megatrends:

Decentralized infrastructure (Web3): A move from centralized cloud services to distributed, user-owned networks.

Edge computing: Data processing happens closer to the source — at home devices instead of remote data centers.

Energy efficiency and sustainability: Ultra-low-power chips allow devices to run continuously without environmental strain.

In this ecosystem, a $30 Lucky Miner plugged into a USB port isn’t just a curiosity — it’s a symbol of digital sovereignty.

2. Integration with Smart Devices and IoT

Imagine a home where every connected appliance has a small compute module capable of contributing to blockchain security or distributed AI processing.

We’re already seeing early examples:

Smart plugs that track energy usage and allocate excess solar power to small miners.

Routers that integrate micro-miners to participate in proof-of-work or proof-of-storage systems.

IoT miners that link to decentralized data or bandwidth marketplaces, earning crypto for idle resources.

In this context, Lottery Miners are a perfect prototype — they’re compact, self-contained, and power-efficient. Their evolution could pave the way for multi-purpose mining devices that serve as both home electronics and blockchain participants.

> The line between “appliance” and “miner” is disappearing.

> In the Web3 home, everything that consumes electricity can also create digital value.

3. Global Decentralization and Energy Localization

One of the greatest challenges facing the Bitcoin network today is geographical concentration — with large percentages of hash power clustered in specific regions like North America and Central Asia. This centralization poses both economic and geopolitical risks.

Lottery Miners, by contrast, disperse hash power globally. A single household miner in Nigeria, Brazil, or the Philippines adds to network diversity.

As more home users participate, the Bitcoin network becomes stronger and more censorship-resistant.

This “energy localization” model — where individuals mine using renewable or surplus household power — also aligns with sustainability goals. Solar-powered and USB-powered miners can repurpose energy that would otherwise go unused, making decentralized finance truly eco-decentralized.

4. Economic and Cultural Implications

The rise of consumer-grade miners represents a cultural turning point. For the first time since Bitcoin’s early days, mining is no longer about industrial dominance — it’s about individual participation.

Just as social media democratized publishing and smartphones democratized computing, Lottery Miners democratize crypto mining.

The economics are profound:

Ultra-low entry cost → lowers barriers for millions of new users.

Gamified mining model → transforms finance into entertainment.

Decentralized ownership → strengthens the resilience of blockchain ecosystems.

It also reshapes how we think about digital labor. Running a miner, no matter how small, becomes a personal act of contribution — part of a new kind of micro-economy, where value generation happens passively, continuously, and globally.

5. The Role of Brands like Lucky Miner

Among the pioneers of this transformation, Lucky Miner stands out for its focus on both technology and accessibility.

Rather than targeting industrial miners, Lucky Miner designs products for everyday users — plug-and-play devices that anyone can operate, even without prior crypto knowledge.

Its products like the BG02 (7TH/s) and BG Lite (2TH/s) combine minimalist design with practical function — small enough for desktops, efficient enough for solar setups, and smart enough to monitor remotely through web dashboards.

In doing so, Lucky Miner isn’t just selling hardware; it’s building an ecosystem — tutorials, forums, firmware updates, and global user communities that bring mining back to where it started: the people.

> “Lucky Miner isn’t competing with industrial rigs,” notes a company engineer.

> “We’re building the future of home-based, decentralized mining — one plug at a time.”

6. Challenges Ahead

Despite the optimism, the path forward isn’t without obstacles.

Regulatory uncertainty: Home mining legality varies across jurisdictions.

Profit unpredictability: Lottery-based rewards depend purely on chance; not every user will “win.”

Hardware limitations: Ultra-low-power miners remain constrained by physics — their main value lies in participation, not predictable yield.

However, these challenges are less about feasibility and more about expectation management. As long as users understand that Lottery Mining is a form of digital participation rather than guaranteed income, adoption will continue to grow organically.

The global trend toward decentralization and personal ownership — in finance, data, and technology — ensures that the spirit behind Lottery Miners will endure.

7. Looking Ahead: The Next Five Years

By 2030, the landscape of crypto mining could look radically different:

Every home device doubles as a node.

Consumer miners integrate AI and renewable energy optimization.

Local blockchain clusters form “micro-grids” of compute and storage power.

Lottery Mining evolves into a hybrid model of proof-of-work + proof-of-participation.

If 2025 is the year home mining went mainstream, 2030 may be the year it becomes invisible — woven seamlessly into daily life.

Mining will no longer be a niche pursuit, but a background function of digital citizenship in the Web3 era.

Conclusion: The Return of the Individual Miner

The gold rush of the 19th century ended when the mines ran dry. The digital gold rush, however, is only beginning — not because of scarcity, but because of infinite participation.

The rise of Lottery Miners represents more than a hardware trend. It’s a philosophical shift — from industrial control to personal empowerment, from profitability to participation, from machines to people.

When you plug in a Lucky Miner, you’re not just mining Bitcoin.

You’re mining possibility — contributing to a global experiment in decentralization, one watt at a time.

The future of mining won’t be measured in terahashes or megawatts.

It’ll be measured in connections — between individuals, homes, and a global network that thrives on collective participation.

Welcome to the new digital gold rush.

Welcome to the age of the Lottery Miner.

Leave a comment