Introduction

Contract trading is an essential concept for novice cryptocurrency enthusiasts looking to explore different methods of engaging with the crypto market. While BTC solo mining has become increasingly popular, contract trading offers a unique approach to benefiting from market fluctuations. This guide explains the fundamentals of contract trading and how Lucky Miner provides an excellent solution for miners looking to optimize their performance with top-tier crypto mining hardware.

What is Contract Trading?

Contract trading, often referred to as futures or options trading, involves entering into agreements to buy or sell an asset at a specific future date for a predetermined price. In the world of cryptocurrency, this practice allows traders to speculate on the price of digital currencies without actually owning them. It's a way to capitalize on price movements while minimizing the need for significant capital investment upfront.

While contract trading is often associated with cryptocurrency exchanges, it complements other activities, like BTC solo mining. Using a high-performance ASIC miner machine like Lucky Miner can improve your mining setup, providing a way to optimize your earnings through better hardware and a diversified approach to cryptocurrency involvement.

The Role of Lucky Miner in Crypto Trading and Mining

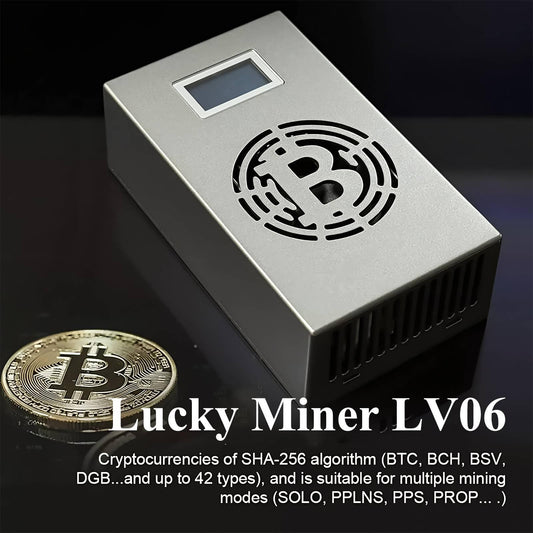

For those involved in BTC solo mining or looking to explore other avenues like contract trading, Lucky Miner offers powerful tools. The Lucky Miner ASIC miner machine is designed to support efficient and high-speed mining. With features like high hash rate, low power consumption, and an effective cooling system, the Lucky Miner ensures that miners get the most out of their hardware, whether they're focused on solo mining or exploring other crypto opportunities.

Many crypto enthusiasts use contract trading as a complementary strategy to their mining activities, diversifying their involvement in the digital asset ecosystem. While contract trading provides an opportunity for price speculation, Lucky Miner helps miners enhance their overall mining experience with reliable, top-of-the-line mining equipment.

Why Contract Trading Appeals to Crypto Enthusiasts

Contract trading is popular among crypto enthusiasts because it allows for more flexibility and potential profit without the need to hold physical coins. It can be especially appealing to those looking to maximize their engagement in the digital currency space beyond just BTC solo mining. By using a combination of Lucky Miner’s advanced hardware and contract trading, traders and miners can optimize their strategies to increase overall participation in the crypto ecosystem.

The advantage of contract trading lies in its ability to act as a hedge against market volatility. For example, if a miner anticipates fluctuations in the price of Bitcoin, they can use contract trading to speculate on these movements while continuing to mine independently. This versatility makes it an attractive option for miners who want to expand their crypto strategies.

Why Choose Lucky Miner for Solo Mining and Contract Trading?

Whether you are engaged in BTC solo mining or interested in contract trading, having reliable crypto mining hardware is crucial for success. Lucky Miner offers the best solo lottery miner for those who want the benefits of efficient mining combined with high-performance hardware.

-

High Hash Rate: The Lucky Miner ASIC miner machine delivers an excellent hash rate, enabling efficient mining operations that yield optimal results for solo miners.

-

Low Power Consumption: By using energy-efficient technology, Lucky Miner reduces power consumption, ensuring that miners can operate their machines without excessive electricity costs.

-

Advanced Cooling System: With its built-in cooling system, the Lucky Miner prevents overheating during long mining sessions, helping to extend the lifespan of your hardware.

Combining Contract Trading with Solo Mining

Many miners use contract trading to diversify their crypto portfolios while still focusing on their primary activity: mining. Combining both strategies can offer an enhanced approach to cryptocurrency participation. Lucky Miner ensures that your mining hardware remains efficient, while contract trading provides opportunities for speculation on market movements. With both methods, you’re equipped to optimize your involvement in the crypto world.

Conclusion

As a cryptocurrency enthusiast, understanding contract trading can provide an additional layer of strategy to your crypto journey. However, no matter your approach—whether focused on BTC solo mining or engaging in contract trading—having access to the best crypto mining hardware is key to long-term success. Lucky Miner offers a powerful and reliable solution, featuring high hash rates, low power consumption, and an efficient cooling system that make it the ideal choice for solo lottery mining and beyond. By combining Lucky Miner’s mining performance with contract trading, you can diversify your crypto strategies and stay ahead in the ever-evolving digital currency market.

Leave a comment