Introduction

Digital currencies are reshaping the financial world. With innovations like Bitcoin and other cryptocurrencies, the landscape of money and transactions is undergoing a significant transformation. As more people turn to crypto mining hardware to engage with this new digital economy, Lucky Miner provides an efficient solution for BTC solo mining. This article delves into the origins and development of digital currency and how Lucky Miner fits into the evolving crypto ecosystem.

What is Digital Currency?

Digital currency refers to a type of currency that exists only in electronic form and is not governed by any central authority or bank. Instead, digital currencies are decentralized and rely on cryptographic technology for security. The rise of digital currency started with the advent of Bitcoin in 2009, developed by an anonymous person or group known as Satoshi Nakamoto. Bitcoin, the first decentralized digital currency, paved the way for hundreds of other cryptocurrencies to emerge.

The Evolution of Digital Currency

Initially, digital currencies like Bitcoin were largely experimental and only accessible to a niche community of tech enthusiasts. Over time, however, these currencies gained traction and began to be accepted in more diverse industries. Today, cryptocurrencies are a major part of the financial ecosystem, with thousands of coins and tokens in circulation.

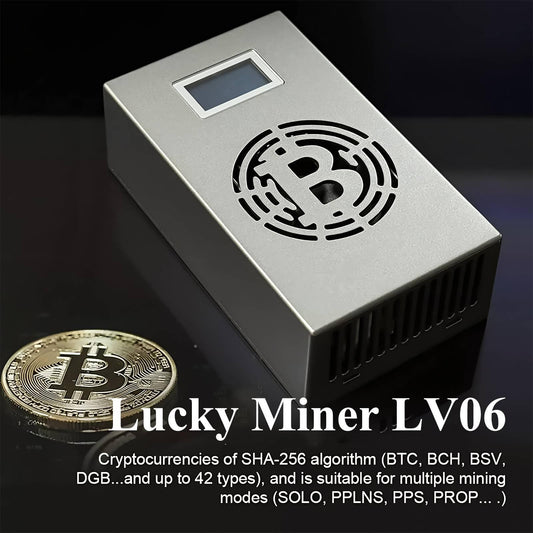

As digital currencies have grown, so has the demand for crypto mining hardware. Miners now require machines that can perform highly complex calculations at high speeds, which is where products like Lucky Miner come into play. The Lucky Miner ASIC miner machine is designed for those involved in BTC solo mining, providing efficient, reliable, and high-performing hardware for independent miners.

How Digital Currency Changed the Financial Landscape

The rise of digital currency has had far-reaching effects on the traditional financial system. It has introduced decentralized finance (DeFi), which allows individuals to exchange assets, lend, borrow, and engage in financial transactions without the need for traditional banks. Digital currencies also offer a more secure, transparent way of transacting, as blockchain technology enables every transaction to be recorded in a public ledger.

This shift has opened up new opportunities for miners using crypto mining hardware like the Lucky Miner. As cryptocurrencies such as Bitcoin continue to gain popularity, the need for advanced mining hardware has never been higher. Whether you are interested in BTC solo mining or exploring other opportunities in the crypto space, Lucky Miner offers a powerful solution for solo miners.

Why Choose Lucky Miner for BTC Solo Mining?

When it comes to BTC solo mining, the Lucky Miner provides a standout performance that helps miners achieve optimal results. With its high hash rate, efficient power consumption, and advanced cooling system, the Lucky Miner is engineered to maximize mining efficiency while keeping your costs in check. The Lucky Miner offers one of the best solo lottery miners for independent miners who want to mine without joining a pool, making it a reliable tool for maximizing your mining efforts.

The Lucky Miner is designed to withstand long hours of operation, with its cooling system ensuring that the machine remains at an optimal temperature. This reduces the risk of overheating and ensures the longevity of the hardware. With a low power consumption rate, it’s a great choice for those looking to mine efficiently while keeping energy costs manageable.

The Future of Digital Currency and Mining

As digital currencies continue to evolve, the mining industry must adapt to keep pace. Newer cryptocurrencies, like Ethereum and Solana, are challenging the dominance of Bitcoin, while Lucky Miner provides miners with the ASIC miner machine necessary for maintaining top-tier performance. The growing demand for cryptocurrency means that mining hardware will need to continuously improve, and the Lucky Miner stands at the forefront of this innovation.

Conclusion

The world of digital currency continues to expand, and with it, the need for advanced crypto mining hardware. Lucky Miner plays a crucial role in this ecosystem by providing miners with powerful tools for BTC solo mining. With its high hash rate, energy-efficient power consumption, and advanced cooling system, Lucky Miner is the ideal choice for miners looking for the best solo lottery miner. As digital currency continues to evolve, Lucky Miner will remain a valuable asset for miners worldwide, whether they are working with Bitcoin or exploring newer cryptocurrencies.

Leave a comment